Retirement planning can feel overwhelming, but starting early makes it much easier. In this ultimate guide for retirement planning, we’ll walk through key steps to build your nest egg and answer the question “how much should you be investing now?”. By defining your retirement goals, choosing the right accounts, and using expert guidelines (like aiming to save around 15% of your income annually, you’ll be better prepared for a comfortable future. Small, consistent contributions today can grow substantially over time thanks to compound interest.

Steps to Plan Retirement

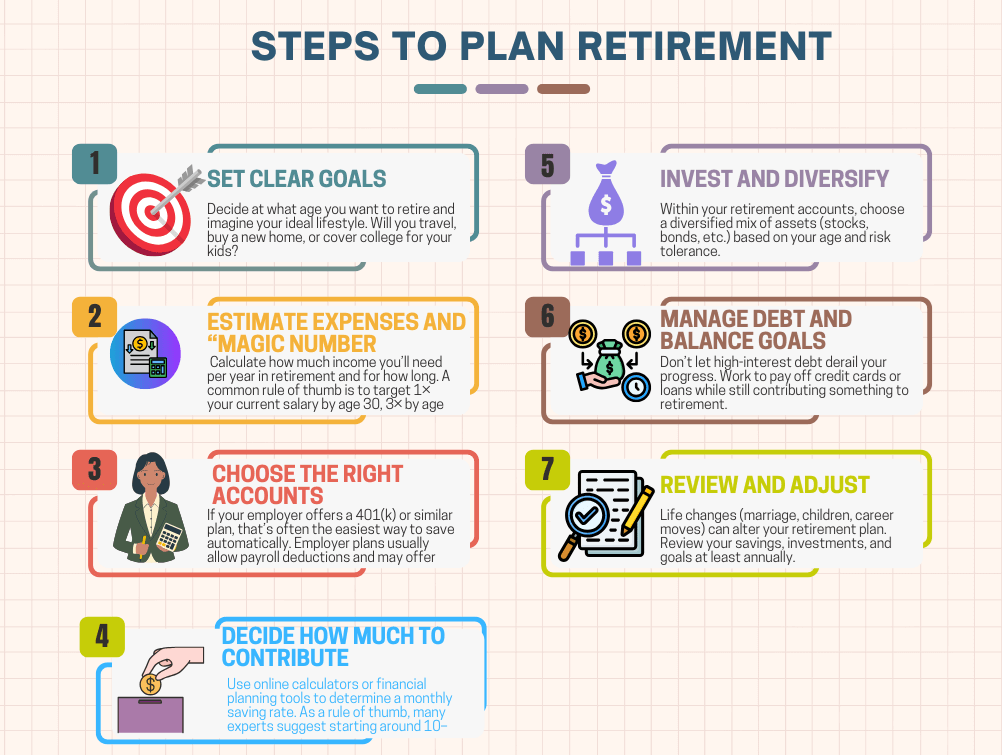

Effective retirement planning is a multi-step process. Breaking it down makes it manageable. Consider these steps to plan your retirement:

- Set clear goals: Decide at what age you want to retire and imagine your ideal lifestyle. Will you travel, buy a new home, or cover college for your kids? Defining goals (age, budget, lifestyle) is the first step. For example, many planners suggest estimating that you may need roughly 70-100% of your current annual income each year in retirement, depending on your lifestyle.

- Estimate expenses and “magic number: Calculate how much income you’ll need per year in retirement and for how long. A common rule of thumb is to target 1× your current salary by age 30, 3× by age 40, 6× by 50, 8× by 60, and about 10× by full retirement age. For instance, a 35-year-old earning \$60,000 would aim to have \$60,000–\$90,000 saved (1–1.5× income) to be on track. These benchmarks are rough guides – your exact needs depend on factors like living costs, health care, and how you plan to spend in retirement.

- Choose the right accounts: If your employer offers a 401(k) or similar plan, that’s often the easiest way to save automatically. Employer plans usually allow payroll deductions and may offer matching contributions (free money). If you don’t have an employer plan or want to save more, consider an IRA (Individual Retirement Account) – either Traditional or Roth. In fact, an IRA is often one of the best retirement plans for individuals because anyone with earned income can open one. Roth IRAs and 401(k)s provide tax-free growth, while Traditional IRAs and 401(k)s offer tax deductions now; both are valuable tools.

- Decide how much to contribute: Use online calculators or financial planning tools to determine a monthly savings rate. As a rule of thumb, many experts suggest starting around 10–15% of your gross income each year (including any employer match) for retirement savings. If that isn’t feasible immediately, begin with what you can and aim to increase it gradually as your salary grows. Automatic payroll contributions can help keep you consistent.

- Invest and diversify: Within your retirement accounts, choose a diversified mix of assets (stocks, bonds, etc.) based on your age and risk tolerance. Younger savers might hold more stocks for growth, while those nearing retirement often shift toward bonds and cash to preserve savings. Remember, diversification doesn’t guarantee gains, but it can help manage risk over decades.

- Manage debt and balance goals: Don’t let high-interest debt derail your progress. Work to pay off credit cards or loans while still contributing something to retirement. Delaying saving can make it harder to catch up later. Conversely, paying down debt (like a mortgage) can free up more income for saving.

- Review and adjust: Life changes (marriage, children, career moves) can alter your retirement plan. Review your savings, investments, and goals at least annually. Many financial firms offer online tools to run scenarios and see how changes (like retiring a few years earlier or later) affect your needs. Adjust your contributions or portfolio as needed to stay on track.

How Much Should You Be Investing Now?

In practice, quantifying how much to invest today can be guided by both calculators and benchmarks. Financial experts often recommend saving about 15% of your income each year (including employer contributions) as a good target. This guideline comes from the assumption that you save consistently and invest for growth over decades. Tools like retirement planning calculators can help you plug in your age, income, and goals to see exactly how much monthly savings would meet your retirement target. For example, if you’re 30 with \$50,000 salary, you might aim for \$50,000 in savings now (1× salary), and then increase contributions over time to maintain pace with your growing income.

If you’re behind schedule, don’t panic – there are catch-up strategies. Fidelity notes that those under 40 should try to save more now and invest for growth, while those over 40 might combine higher savings with extended working years. The key is to act: increasing contributions even by 1% can make a noticeable difference over time. And remember, you typically have years (often decades) to reach your ultimate goals, so steady progress – even in small increments – pays off thanks to compound interest.

Retirement Plans for Individuals

Choosing the best retirement plans depends on your situation. Employer-sponsored plans like 401(k)s (private sector) or 403(b)s (for nonprofit employees) are great because of higher contribution limits and often an employer match. A matched 401(k) contribution is essentially free money, so it’s wise to contribute at least enough to get the full match. These plans grow tax-deferred (Traditional 401(k)) or tax-free (Roth 401(k)), and for 2025 you can put in up to \$23,500 (\$31,000 if age 50+) in a 401(k).

Individual Retirement Accounts (IRAs) are another cornerstone. Anyone with earned income can open an IRA, making it one of the best retirement plans for individuals. Traditional IRAs let you deduct contributions (tax breaks now) and pay tax on withdrawals later, while Roth IRAs use after-tax money and allow tax-free growth and withdrawals. The 2025 contribution limit is \$7,000 per year (plus \$1,000 catch-up if age 50+). You can actually use both a workplace plan and an IRA in the same year to maximize savings.

For self-employed workers or small-business owners, other plans exist (like SEP-IRAs or solo 401(k)s) with even higher limits. But for most individuals, a combination of a 401(k)/403(b) at work and a Roth or Traditional IRA on the side covers the best retirement plans available.

Best Ways to Save for Retirement

- Start Early and Be Consistent: Time is your ally. The best way to save for retirement is simply to start saving today, no matter how small the amount. Thanks to compound interest, even modest savings in your 20s can grow significantly by retirement. Waiting just a few years can dramatically increase how much you need to save later, so begin as soon as you can and contribute regularly.

- Automate Contributions: One of the best tactics is to automate your savings. Set up automatic payroll deductions into your retirement account(s) each pay period. This “pay yourself first” approach ensures saving happens consistently and reduces the temptation to spend that money elsewhere. Over time, you can increase the percentage (for example, raising your 401(k) contribution by 1% each year) to edge closer to your target.

- Maximize Employer Match: If your employer matches 401(k) contributions (e.g., 50¢ on the dollar up to a limit), make sure to contribute at least enough to get the full match. This is effectively an immediate 50% return on those contributions – a benefit few other investments offer.

- Diversify and Rebalance: Invest your retirement savings in a mix of asset types. Early on, you might favor higher-growth investments (like stocks), then gradually shift to more stable ones (like bonds or cash) as retirement nears. Diversification can help protect your portfolio from market swings, and rebalancing annually can keep your risk on track.

- Mind Your Debt: Balancing saving with debt repayment is important. Try to pay down high-interest debt (like credit cards) first, but continue contributing to retirement at least modestly. Delaying saving to clear debt can set you back, because making no progress on retirement means you must save that much more later. Aim to pay off or substantially reduce debts before entering retirement.

- Review and Adjust: Your situation will change (income fluctuations, life events, etc.), so regularly revisit your plan. Use financial tools and calculators to see if you’re on track. If you get a raise or bonus, consider directing part of it to your retirement accounts. Adjust your savings rate if you fall behind, or shift your investment mix if needed to match your age and comfort with risk.

By following these strategies and staying disciplined, you’re using the best ways to save for retirement. Remember: small actions now can lead to big results later.

Each person’s situation is unique, but following these guidelines and asking the right questions will help you build confidence in your retirement plan. Regularly revisit your strategy and stay committed – with time on your side, you’ll improve your chances of a secure retirement.

At Next Insight Technologies, we simplify financial knowledge for everyone. Whether you’re planning your retirement or exploring the best retirement plans, our resources help you make confident choices. Stay updated with our latest insights, or reach out to us to learn more about building a secure financial future.

Frequently Asked Questions on Retirement Planning & Investments

Financial experts often recommend saving around 15% of your pre-tax income each year for retirement (including any employer match). This rule assumes you start early and consistently contribute. If 15% isn’t feasible now, begin with a lower percentage and gradually increase it over time.

Starting in your 20s or 30s gives your savings decades to grow through compound interest. Even small contributions early on can become significant. It’s never too late to start, but the earlier you begin, the less you’ll need to save each year to reach the same goal.

If available, contribute to an employer-sponsored plan (like a 401(k) or 403(b)), especially enough to earn any company match. Additionally, use an IRA (Individual Retirement Account) each year – a Roth IRA for tax-free withdrawals or a Traditional IRA for up-front deductions. These accounts, individually or together, are among the best retirement plans for individuals.

A simple benchmark is to aim for about 1× your salary saved by age 30, 3× by 40, 6× by 50, 8× by 60, and roughly 10× by full retirement age. You can use retirement calculators to plug in your own figures (age, income, desired retirement age) for a more personalized estimate.

A standard guideline is the 4% rule: withdraw no more than about 4% of your retirement savings per year (adjusted for inflation) to help ensure your funds last through retirement. Depending on market performance and lifespan, some experts say up to 4–5% may be sustainable. The key is to balance withdrawals with longevity of savings and to adjust if your portfolio underperforms.

Don’t panic – take action. Save more aggressively now if you can, pay off debts to free up income, and consider delaying retirement by a few years. Experts suggest increasing contributions and investing for growth (e.g., in a diversified stock portfolio) if you’re under 4. If you’re older, balance higher savings with potentially working part-time longer. Every extra dollar saved and earned can significantly improve your outlook.

The best way is to start early and save consistently. Automate contributions to your retirement accounts so saving happens every paycheck. Always capture any employer match. Keep your retirement savings a priority even when tackling other goals. In short, make saving a habit: even small amounts put in motion today become much larger sums over time.